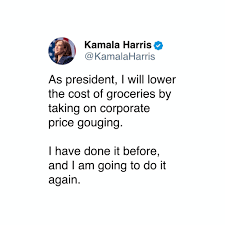

I remember the good old days when Republicans (rightly) criticized Democrat leaders like Joe Biden, Kamala Harris, and Elizabeth Warren for pushing price controls on groceries following the large inflation that occurred post-COVID.

The explanation for why this occurred is quite obvious: when there’s inflation coming from money supply increases, the demand for most goods will rise. This increase in demand will push prices up. Instead, many Democrat politicians and supporters blamed it on corporate greed and price gouging. The Federal Reserve Bank of San Francisco found that markups (or “price gouging”) cannot explain the rise in inflation.

Those advocating for pushback against these proposals were correct. So far, so good.

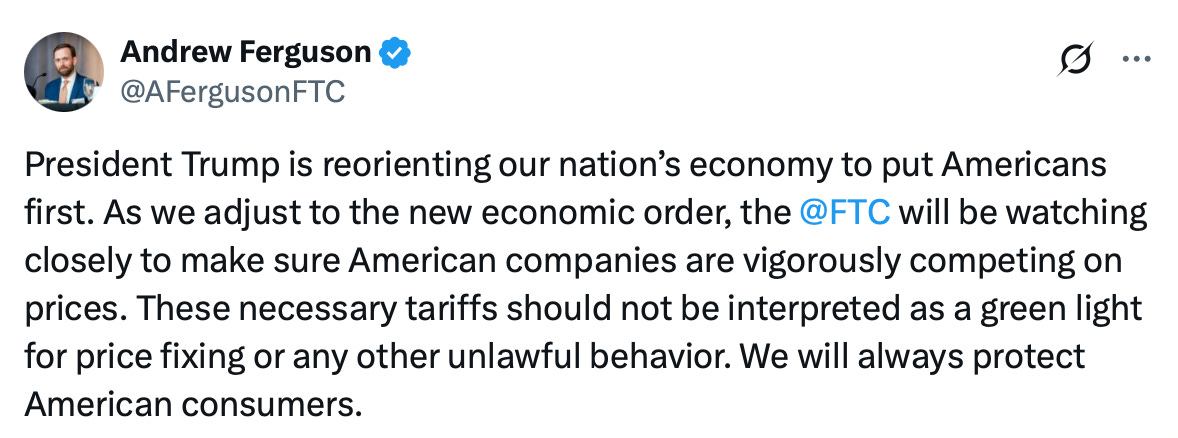

Unfortunately… this argument is back! But now, it’s coming from the MAGA right.

The Chairman of the Federal Trade Commission last week came out with a threat to U.S. companies to ensure they are not “price fixing” in response to these tariffs. While the sentiment of “protecting consumers” is noble, they have no one to blame but themselves (from the tariffs) for price increases that we will see. If they really wanted to “protect consumers” from increasing costs, they wouldn’t implement tariffs at these outrageously high rates.

Prices are signals to the broader market; they communicate demand for goods and relative scarcity for such goods. This “signal” incentivizes producers to make more goods and consumers to use less. Price controls always fail to achieve their intended outcomes. They cause a “disequilibrium” effect that leads to shortages: there are more people who are willing to buy the product than sellers who are willing and able to sell the product at this new controlled price. These lead to shortages, other forms of rationing, and black markets.

We’ve already tried this in the U.S. when there was a large inflationary effect during Nixon’s presidency. Nixon put a freeze on prices and wages, which sounded like a good idea but was a textbook failure. There were massive shortages and long waiting lines for basic goods, and many notable products (like meat) disappeared from stores.

Instead of blaming companies for their cost of production rising, blame the root cause of those increases. Given the complexities of supply chains and manufacturing, a sudden and large shock to the cost of production (tariffs) is going to have devasting impacts on the U.S. economy. In the manufacturing of cars, for example, cars move from Canada, Mexico, and the U.S. over seven times during the production process. If manufacturers have to pay tariffs at each and every step, the cost of cars will balloon, and consumers will be made worse off.

Even for purely U.S.-made goods, there will be high-cost implications. This is because even if the product is made in the U.S., the machinery used in the production line often is not. This means that their cost of production will inevitably rise. There’s also the uncertainty effect of these tariff policies. We do not know how long they will last and to what extent. Businesses before making large-scale investment decisions, like moving their plants to the U.S., need a level of certainty. Given the likely unconstitutionality of these policies (by using executive powers in a “state of emergency” declaration), no one truly knows what these policies will look like come the summer, much less over the next year and beyond.

Price controls are not (and have never been) the answer.